A taste of things to come nearer to home?

- devaluation and inflation in Venezuela

- government caught faking inflation statistics in Argentina

- major bank liquidated in Ireland

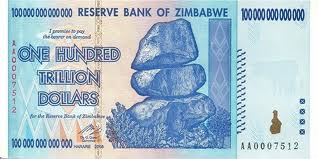

Venezuelans lost 40% of their savings value in this month's devaluation and are loosing 22% a year from inflation. Combined that means their money is halving each year - doesn't take many years of that to have no money left (Wiemar Germany or Zimbabwe anyone?)

Venezuelans lost 40% of their savings value in this month's devaluation and are loosing 22% a year from inflation. Combined that means their money is halving each year - doesn't take many years of that to have no money left (Wiemar Germany or Zimbabwe anyone?)

Annual inflation accelerated to 22.2 percent in January, the fastest pace in eight months, led by a jump in food prices. Prices climbed 3.3 percent in January after rising 3.5 percent in December.

Venezuela devalued its currency for the fifth time in nine years

from http://www.bloomberg.com/news/2013-02-08/venezuela-devalues-currency-from-33-to-6-30-bolivars-per-dollar.html

more analysis and graph at http://www.zerohedge.com/news/2013-02-08/venezuela-devalues-its-currency-32

and in related news the Argentine government has been faking the inflation statistics (this is also done in UK and US but Argentina is worst and got caught doing it) This is a clear sign, that the government is trying to combat the EFFECTS of inflation and not the ORIGINS (either because things are so bad they are out of their control or the government it self is cosing rampant inflation through money printing which it simply refuses to stop)and therefore is doomed to failure.

the International Monetary Fund (IMF) censured Argentina for issuing inaccurate economic data.The government says inflation is below 11%, but economists say the real rate is double that.

Analysts have accused Argentina specifically of understating the rate of inflation since 2007 to keep interest rate payments on its debt low and to flatter the political regime.

Some economists think the annual inflation rate could rise as high as 30% this year.

from http://news.liveandinvestoverseas.com/Economy/argentina-freezes-supermarket-prices-for-two-months.html

and across the Irish sea a major bank is liquidated

The Irish government passed emergency legislation on Thursday to liquidate Anglo Irish Bank, one of Ireland’s largest financial institutions.The legislation, which was signed into law after an all-night parliamentary session, came after negotiations with the European Central Bank over swapping so-called promissory notes, which were used to bail out the Irish lender in 2009, for long-term government bonds.

from http://news.liveandinvestoverseas.com/Economy/ireland-to-liquidate-anglo-irish-bank.html