Here’s the News from 2100

By Karl Albrecht

Dateline: January 1, 2100

Futures experts are now more divided than ever about the fate of humanity, according to World Future Society president Timothy Mack, whose brain spoke to us from his jar in the Johns Hopkins Medical Lab.

“There are two schools of futurists,” Mack explained. “There are the ‘gee-whiz’ types, whose mantra is EGBOK: ‘Everything’s Going to Be OK.’ And then there are those whose slogan is WIDD: We’re in Deep Do-Do.’” Mack’s avatar shrugged its shoulders. “I don’t know who to believe.”

Elsewhere in the futures world, Cynthia Wagner, long-serving executive editor of the society’s magazine The Futurist, confirmed that she has had the text of every article and book about the future ever published embedded in her DNA. “I couldn’t decide about the Nostradamus stuff,” she said, “but I finally included that, too.”

Speaking at the Society’s 134th annual conference, held at the Ray Bradbury Center on Mars, World Future Society founder and leading thinker Ed Cornish appeared onstage in his specially outfitted brain-mobile. His address, titled “Is the Future Here Yet?” was greeted with thunderous applause signals from the 5,000 brains in attendance.

Meanwhile, technology futurist Ray Kurzweil expressed satisfaction that 24 countries have now abolished individual names. Hereafter, all babies will be named Chip, with the serial numbers of their microchips replacing their family names. Don Tapscott, whose sixty-fourth book is titled Are You a Digital Dodo? agreed. According to Tapscott, “Today’s kids are fully digitized. The older generation will be left behind if they can’t make the brain-to-chip transformation.”

In other tech news, Google announced that it now has the DNA sequence of every human being on the planet in its database.

In the world of social media, Mark Zuckerberg, ex-CEO of the now-defunct Facebook corporation, has filed for personal bankruptcy. “We’re still showing 16.2 billion users in our database,” he said. “But we discovered that only 104 of them are still active. There’s a terrorist cell in Iowa, a few dozen college students, and a group of senior citizens in Miami Beach.” Zuckerberg had applied for welfare support in California, only to find that it had been abolished by the last 10 Republican governors. “I guess I’ll have to find a job,” he said.

Returning to generational issues, the U.S. Defense Department’s Population Control Command reports increasing difficulty in performing its mission of tracking down and shooting over-aged people.

“We’ve been tracking this one old grandma for months,” said Colonel Bo Gritz. “She’s picked off three of my best men. It’ll probably cost more to wipe her out than to just let her keep on living. We’ll have to get her with a drone.”

England’s Queen Elizabeth, that country’s longest-serving monarch, attended memorial services for her grandson Prince William, who—like his father, Prince Charles—died of natural causes. Close family members, speaking on condition of anonymity, reported that the Prince’s last words were, “I was hoping to be king for a little while, at least.” The Queen’s physician refused to comment on the secret herbal preparation he’s reportedly been giving her for the past 60 years.

Turning now to political news, the U.S. Congress is putting the final touches on legislation that will legalize marriage between human beings and computers. Marriage between human beings of the same sex, however, remains illegal.

In the economic sector, the states of Alabama, Arkansas, Kentucky, Mississippi, Tennessee, and West Virginia have announced plans to merge into one state, to head off impending bankruptcy. This latest in a series of mergers brings the number of states to 17. Supported by a large infusion of cash from the Indian government, the new state will be named Bubbastan.

On the religion front, the Vatican announced today that it has formed a special council to investigate what it describes as “possibly overblown” charges of predatory sexual behavior by priests. The commission is on a fast track to deliver its findings by mid-2125.

In international news, the Chinese government confirmed that it’s in negotiations to buy Kansas. China’s spokesperson, Hu Mi, explained, “We need to guarantee a secure source of wheat and other food grains for our people.” Kansas Governor Randy Kunkel declined comment except to say, “I’ve always been fond of Chinese food.”

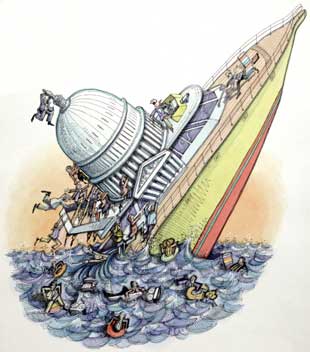

Turning to Wall Street, banking giant OneBank has completed its acquisition of the last remaining bank in the United States, giving it control over 400 million customers who have nowhere else to go for banking services, loans, mortgages, and credit cards. The Secretary of the Treasury, who was formerly the CEO of OneBank, announced the event, saying, “This action will streamline the nation’s financial services industry, eliminate destructive competition, and provide great services to banking customers.”

In entertainment news, reality star Miki Kardashian, granddaughter of the legendary Kim Kardashian, caused controversy at the annual TV awards festival by sending her detachable breasts instead of appearing in person. Her PR spokesperson replied to reporters’ questions with, “What’s the big problem? She had a schedule conflict. Those are the only parts people want to see anyway.”

Also on the entertainment scene, venerable comedienne Betty White has launched her latest show, Hot Sex for Hot Seniors, to air this fall. When asked by reporters how old the actress is, the show’s producer said, “God only knows. Cancel that. I think she’s older than God. But she’s still hot.”

About the author:

Karl Albrecht is a management consultant and author of more than 20 books on professional achievement, organizational performance, and business strategy, including Social Intelligence: The New Science of Success and Practical Intelligence: The Art and Science of Common Sense. Originally a physicist, and having served as a military intelligence officer and business executive, he now consults, lectures, and writes about whatever he thinks would be fun. Web site www.KarlAlbrecht.com.

This entry was posted on November 12, 2012 at 5:08 PM and has received 1266 views. There are currently 0 comments.

Print this entry.

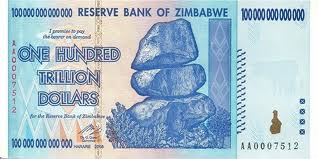

Venezuelans lost 40% of their savings value in this month's devaluation and are loosing 22% a year from inflation. Combined that means their money is halving each year - doesn't take many years of that to have no money left (Wiemar Germany or Zimbabwe anyone?)

Venezuelans lost 40% of their savings value in this month's devaluation and are loosing 22% a year from inflation. Combined that means their money is halving each year - doesn't take many years of that to have no money left (Wiemar Germany or Zimbabwe anyone?)