In this article Armstrong explores how empires like the US, British, Roman and German medieval city states died (or in the US case will die).

So what should we expect? As the economy collapses, people will hoard and spend less. This is the check and balance against HYPERINFLATION. Furthermore, there are huge political ramifications involving a CORE RESERVE CURRENCY compared to Zimbabwe or Germany in the 1920s that cannot be ignored. The dollar cannot move into HYPERINFLATION for it is the reserve currency that would bring everything down with it. Empires do not die in that manner. The value of the dollar will certainly decline against assets, but it will not move into HYPERINFLATION. World War III would breakout before that.

Capital cannot simply flee to yuan, Brazil or any other place, because if the reserve currency goes, so does everything else. China’s reserves would vanish overnight. The notion of HYPERINFLATION is nice – just not practical. Empires collapse they have never expired by HYPERINFLATION. When an empire dies that is the major reserve of all nations, we must be concerned about a complete meltdown and the breakup of the nation long-before HYPERINFLATION UNDERGROUND economy and a store of wealth in time of political crisis. Remember – institutions will always be vulnerable to seizure. So never leave your gold in a bank that could be seized. You are defeating the very purpose of buying gold in such circumstances.

During the worst periods of the Great Depression, many communities were temporarily deprived of normal monetary supplies and functions because of bank failures, hoarding of money, and inability to collect taxes. People simply had no money to spend. To counteract this situation, various forms emergency currency or “scrip” were issued. The first of these appeared as early as 1931, though it was not until a year later that it was being issued in any appreciable quantities. By February of 1933, according to a Bureau of Foreign and Domestic Affairs estimate, there were over 400 communities using some form of emergency fiat currency – and this was before the official “bank holiday” and the resulting flood of scrip across the country. Gold was hoarded – not used as money.

Clearly, people will create money if the state fails to provide it. Roman coins exist in quantity today solely due to the very same human trends that appear in every crisis – hoarding. This reduces the VELOCITY of money creating DEFLATION yet INFLATION as costs rise..

I have stated numerous times that the purchasing power of the Roman denarius collapsed to the point it purchased 1/50th of its previous worth. The German Hyperinflation was 170 marks to the dollar at the beginning to 87 trillion. To compare this with the fall of Rome with money dropping to 1/50th of its former value, that is only 170 to 8500. Rome did not go the way of hyperinflation. It was the CORE economy and it collapse at 170 to 8500 level not 170 to 87 trillion.

Sorry, but you can die in a desert from extreme heat or freeze to death in Antarctica from extreme cold. To survive, we need a temperate climate to live within. DEFLATION or INFLATION can kill an economy. Empires do not die by HYPERINFLATION – that is reserved for the fringe. When an empire dies, it historically has ALWAYS been by DEFLATION/STAGFLATION. How? Real wealth is driven from the ABOVEGROUND economy into the UNDERGROUND economy where it is hoarded and tucked away. This is why we find hoards of Roman coins. This reduces the VELOCITY of money and commerce collapses. This is ALWAYS AND WITHOUT EXCEPTION how empires die. This is why there was “scrip” issued in the United States during the Great Depression. The VELOCITY of money came to a halt in different regions.

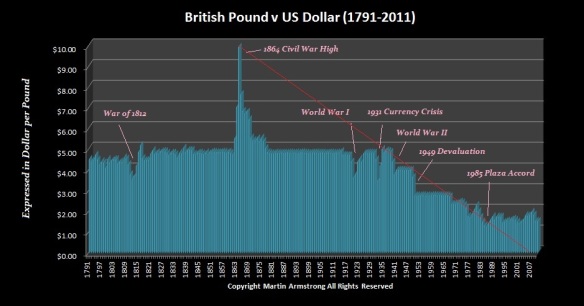

The British Empire did not die of HYPERINFLATION. The pound collapsed in value. It did not inflate into oblivion. The British Empire simply rolled over and died. The decline of the sterling silver penny of England was no different a path than the decline and fall of Rome. The United States will follow the same path and that means there is a risk that it will break apart into regional sections ONLY AFTER the dollar is hit very hard following Europe and then Japan.