This prediction of Financial Chaos was written by financial and spiritual pioneer John Templeton in 2005 before the housing bubble burst, before the 2008 financial crash. Publically released in 2010 many of the items in it have already happened, others may be yet to come.

- Peak prosperity (in 2005) is now behind us

- Extra money supply will cause inflation with will cause bank deposits and government bonds to lose real value

- Peak debt (mortgage and other) will default/mark down in value and will be bailed out by government (eg Fannie Mae, Mortgage Back Securities $20 billion federal purchases per month)

- Surplus capacity in air and ocean transport will lead to lower prices and shake outs of inefficient companies

- Many universities will be replaced by electronic learning

- Many intuitions protected from change by government, labor or entrenched bureaucracies will collapse as outside change accelerates over the next 50 years

- Computers and other electronics will rapidly increase in skills, helping people be more efficient including the illiterate (eg iPhone Siri talking servant)

- Increased global competition and downward pressure on company profits

- Top earners, innovators and nations allowing freedom will prosper much more rapidly than the rest of people and countries

John M. Templeton

Lyford Cay, Nassau, BahamasMEMORANDUM (June 15, 2005)

Financial Chaos — probably in many nations in the next five years. The word chaos is chosen to express likelihood of reduced profit margin at the same time as acceleration in cost of living.

Increasingly often, people ask my opinion on what is likely to happen financially. I am now thinking that the dangers are more numerous and larger than ever before in my lifetime. Quite likely, in the early months of 2005, the peak of prosperity is behind us.

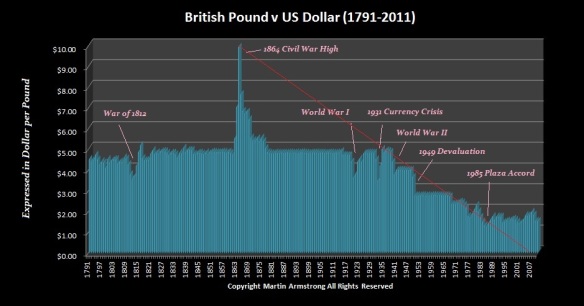

In the past century, protection could be obtained by keeping your net worth in cash or government bonds. Now, the surplus capacities are so great that most currencies and bonds are likely to continue losing their purchasing power.

Mortgages and other forms of debts are over tenfold greater now than ever before 1970, which can cause manifold increases in bankruptcy auctions.

Surplus capacity, which leads to intense competition, has already shown devastating effects on companies who operate airlines and is now beginning to show in companies in ocean shipping and other activities. Also, the present surpluses of cash and liquid assets have pushed yields on bonds and mortgages almost to zero when adjusted for higher cost of living. Clearly, major corrections are likely in the next few years.

Most of the methods of universities and other schools which require residence have become hopelessly obsolete. Probably over half of the universities in the world will disappear quickly over the next thirty years.

Obsolescence is likely to have a devastating effect in a wide variety of human activities, especially in those where advancement is hindered by labor unions or other bureaucracies or by government regulations.

Increasing freedom of competition is likely to cause most established institutions to disappear with the next fifty years, especially in nations where there are limits on free competition.

Accelerating competition is likely to cause profit margins to continue to decrease and even become negative in various industries. Over tenfold more persons hopelessly indebted leads to multiplying bankruptcies not only for them but for many businesses that extend credit without collateral. Voters are likely to enact rescue subsidies, which transfer the debts to governments, such as Fannie May and Freddie Mac.

Research and discoveries and efficiency are likely to continue to accelerate. Probably, as quickly as fifty years, as much as ninety percent of education will be done by electronics.

Now, with almost one hundred independent nations on earth and rapid advancements in communication, the top one percent of people are likely to progress more rapidly than the others. Such top one percent may consist of those who are multi-millionaires and also, those who are innovators and also, those with top intellectual abilities. Comparisons show that prosperity flows toward those nations having most freedom of competition.

Especially, electronic computers are likely to become helpful in all human activities including even persons who have not yet learned to read.

Hopefully, many of you can help us to find published journals and websites and electronic search engines to help us benefit from accelerating research and discoveries.

Not yet have I found any better method to prosper during the future financial chaos, which is likely to last many years, than to keep your net worth in shares of those corporations that have proven to have the widest profit margins and the most rapidly increasing profits. Earning power is likely to continue to be valuable, especially if diversified among many nations.